What is a Credit Score and How is it Calculated?

At Fummaa Credit Fix, we believe that understanding your credit score is the first step toward achieving financial empowerment. Whether you’re looking to secure a mortgage, obtain a better interest rate, or simply build your credit, knowing how your credit score is determined can make a significant difference. Let’s explore what a credit score is and how it’s calculated.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, usually ranging from 300 to 850. Lenders utilize this score to evaluate the risk associated with lending you money or extending credit. A higher score signifies lower risk, increasing your chances of being approved for credit on favorable terms.

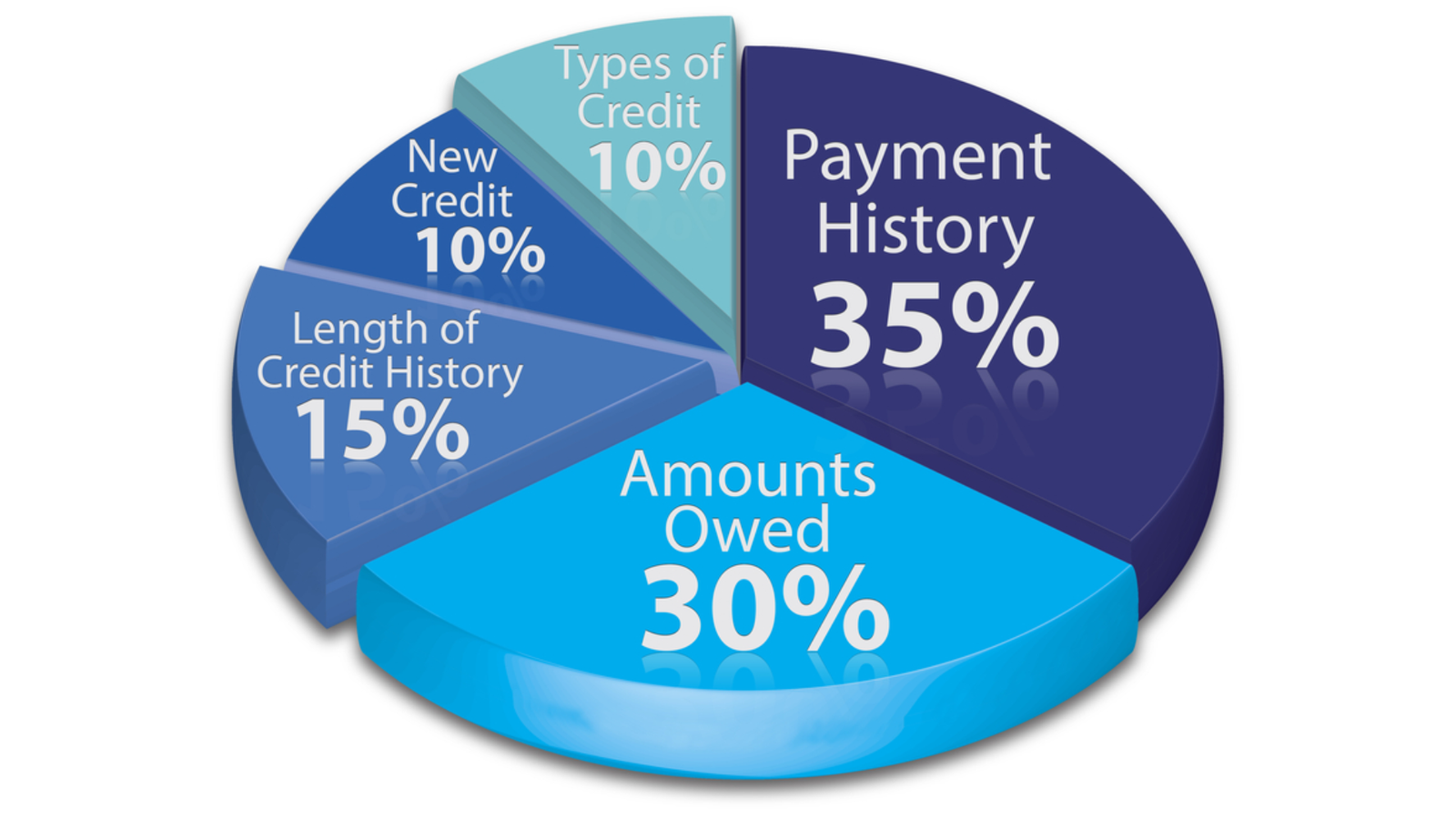

How is a Credit Score Calculated?

Credit scores are derived from several factors found in your credit report, each contributing differently to your final score. Here’s a breakdown of these components:

Payment History (35%)

Your payment history is the most crucial factor, reflecting whether you have paid past credit accounts on time. Late payments, collections, and bankruptcies can adversely affect this aspect of your score.

Credit Utilization (30%)

This metric gauges how much of your available credit you are using. It’s calculated by dividing your total credit card balances by your total credit card limits. To maintain a healthy score, it’s generally recommended to keep your utilization below 30%.

Length of Credit History (15%)

The age of your credit accounts plays a role in your score. This includes the age of your oldest account, the age of your newest account, and the average age of all your accounts. Longer credit histories are usually regarded more favorably.

Credit Mix (10%)

This factor examines the variety of credit accounts you possess, such as credit cards, mortgages, auto loans, and installment loans. A diverse mix of credit types can positively impact your score, indicating that you can manage various kinds of credit.

New Credit (10%)

Every time you apply for new credit, a hard inquiry is added to your credit report. Having too many inquiries in a short period can lower your score. This category also considers the number of recently opened accounts.

Tips for Improving Your Credit Score

With a better understanding of what influences your credit score, here are some tips to help you improve it:

- Pay Your Bills on Time: Set up payment reminders or automatic payments to avoid missing due dates.

- Reduce Your Debt: Work on lowering your credit card balances and maintaining a low credit utilization ratio.

- Avoid Opening Too Many Accounts at Once: Space out your credit applications to reduce the number of hard inquiries on your report.

- Monitor Your Credit Report: Regularly check your credit report for errors and dispute any inaccuracies you encounter.

Why Your Credit Score Matters

Your credit score impacts more than just your ability to borrow money; it can also affect your insurance premiums, your ability to rent an apartment, and even job opportunities. Keeping a good credit score opens doors to better financial prospects and can help you save money over time.

At Fummaa Credit Fix, we are committed to helping you understand and improve your credit score. By staying informed about the factors that affect your score and taking proactive measures to enhance it, you can achieve greater financial stability and success.

Ready to take charge of your financial future? Contact us today for personalized credit repair services!